Pengaturan trading yang fleksibel. The market allows farmers hedge funds and municipalities to hedge bets on the future price of.

Why Water Won T Make It As A Major Commodity Bloomberg

Why Water Won T Make It As A Major Commodity Bloomberg

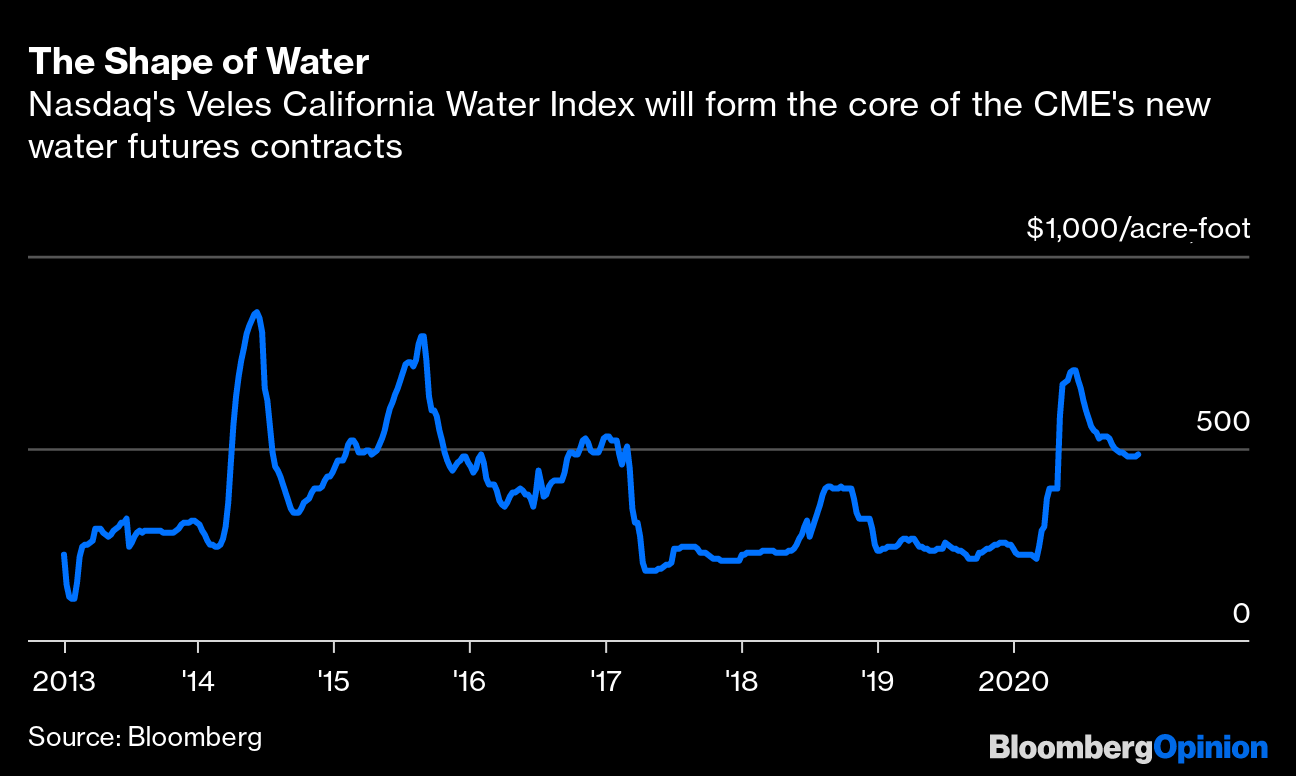

The CME Group is set to launch futures contracts tied to the spot price of water for the first time ever this week.

Water commodity trading. Wall Street has begun trading water as a commodity like gold or oil. Trade Major Company Stocks with an Experienced Trustworthy Broker. Some industry experts such as Richard Sandor expect full-scale trading of water commodity futures within the next five to ten years.

What is water trading. Consider that water - lots of water - is needed to manufacture modern consumer staples like chocolate and wine. It is a barometer consisting of a large number of international and domestic companies that are.

Water has joined gold oil and other commodities that are traded on Wall Street as worries about the uncertainty of its availability in the future rises. The contracts will allow investors and. If youre interested in agricultural commodity markets heavily impacted by water see these guides on.

New York CNN Business Theres a new commodity in town for investors to trade. Trade Major Company Stocks with an Experienced Trustworthy Broker. Water is just as scarce as oil or any other commodity.

CME Group the worlds driving subordinates commercial center and Nasdaq today reported designs for another future contract on the Nasdaq Veles California Water Index NQH2O. Only you are more in touch with water than gold. Considering the climate change water will presently be exchanged as trade at the US Commodities Markets most likely before the current year is over.

How barley is produced. Coba strategi Anda dengan perdagangan kecil mulai dari 1. Futures tied to the Nasdaq Veles California Water Index which measures the volume-weighted average price of.

One such water futures product is CMEs NSH2O. Ad Buat prediksi dan lihat hasilnya dalam 1 menit. The USs water trade market the first of its kind was launched on the Chicago Mercantile Exchange with 11 billion in.

Wall Street just started trading water as a commodity like gold and oil. 3 Ways You Can Invest in Water. To learn about different ways you can trade water as a commodity see this Water Trading Guide.

Apart from the educational and other resources made available online another important factor for traders to consider when looking for Water commodity broker is the platform that a Water commodity broker offer. Sandor worked as an economist with the CME Group and was behind the creation of interest rate futures so its safe to say he knows what he is talking about. Ad Buat prediksi dan lihat hasilnya dalam 1 menit.

How feeder cattle are raised and sold. Retail traders may purchase water rights in the form of company shares or water futures. Bonus sambutan untuk pemula.

Water Index is composed of approximately 29 stocks. The countrys first water market launched on the Chicago Mercantile Exchange this week with 11 billion in contracts tied to water prices in California Bloomberg News reported. Trading the financial markets with Water commodity broker when conditions are volatile can be difficult even for experienced traders.

Pengaturan trading yang fleksibel. See the different ways to trade water to learn more. Ad Get Real-Time Data Straight from The Two Largest Stock Exchanges NYSE and NASDAQ.

Coba strategi Anda dengan perdagangan kecil mulai dari 1. What drives corn prices. Now having water trade in the futures market will guide the farmers for both current market price and expected future developments so that they can hedge against higher prices in the month they will need additional water for their fields.

In fact it takes 872 gallons of water to create one gallon of wine. The value of lean hogs in the agricultural market. The Dow Jones US.

The market allows farmers hedge funds and municipalities to hedge bets on the future price of water and water availability in the American West. Yes water rights can be sold by companies and organizations who own rights to various water resources or systems. Bonus sambutan untuk pemula.

Water begins trading on Wall Street in the Futures Market for fear of shortages. According to Business Insider for the first time ever water is going to be traded as a futures commodity. Ad Get Real-Time Data Straight from The Two Largest Stock Exchanges NYSE and NASDAQ.

Wall Street Is Set To Start Trading In A New Commodity Water

Wall Street Is Set To Start Trading In A New Commodity Water

Are Water Futures Now Sold On Commodity Exchanges Quora

15 Best Water Commodity Broker 2021 Comparebrokers Co

15 Best Water Commodity Broker 2021 Comparebrokers Co

Wall Street Begins Trading Water Futures As A Commodity Yale E360

Wall Street Begins Trading Water Futures As A Commodity Yale E360

What Makes Water A Commodity The Big Drivers Of Demand And Price In 2021 Commodity Com

What Makes Water A Commodity The Big Drivers Of Demand And Price In 2021 Commodity Com

Why Water Won T Make It As A Major Commodity Bloomberg

Why Water Won T Make It As A Major Commodity Bloomberg

California Water Futures Begin Trading Amid Fear Of Scarcity Bloomberg

California Water Futures Begin Trading Amid Fear Of Scarcity Bloomberg

Water New Commodity To Trade In Wall Street Scope Markets

The Price Of A Precious Commodity Water Trading In Australia Vox Cepr Policy Portal

The Price Of A Precious Commodity Water Trading In Australia Vox Cepr Policy Portal

Water Trading In 2021 Ways To Bet On Water With Regulated Brokers Commodity Com

Water Trading In 2021 Ways To Bet On Water With Regulated Brokers Commodity Com

Water Is Now A Traded Commodity Can It Still Be A Human Right Too The Swaddle

Water Is Now A Traded Commodity Can It Still Be A Human Right Too The Swaddle

Background To Commodity Trading Responsible Trading Project

Background To Commodity Trading Responsible Trading Project

What Makes Water A Commodity The Big Drivers Of Demand And Price In 2021 Commodity Com

What Makes Water A Commodity The Big Drivers Of Demand And Price In 2021 Commodity Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.