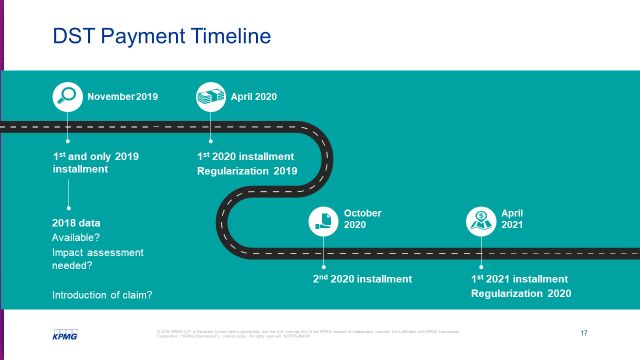

On 23 and 30 March 2020 the French Tax Authorities FTA issued new draft guidance with respect to the Digital Services Tax DST. The French digital services tax is a 3 revenue tax designed to collect money from companies providing digital services to French citizens.

Macron Claims Deal To End Digital Service Tax Fight With The Us Ars Technica

Macron Claims Deal To End Digital Service Tax Fight With The Us Ars Technica

France is seeking a 3 percent tax on the revenues that companies earn from providing digital services to French users.

France digital services tax. Section 301 Hearing in the Investigation of Frances Digital Services Tax August 19 Panel Schedule. France has approved a digital services tax despite threats of retaliation by the US which argues that it unfairly targets American tech giants. The French DST is a three percent tax on the revenue of digital companies providing advertising services selling user data for advertising purposes or performing intermediation services.

Deemed French services A user of a digital interface is deemed to be located in France if he visits such interface through a terminal located in France. Companies with global revenues of EUR750m USD880m or more and French sales of at least EUR25m are required to pay the tax. The draft guidance is subject to public consultation until 23 May 2020.

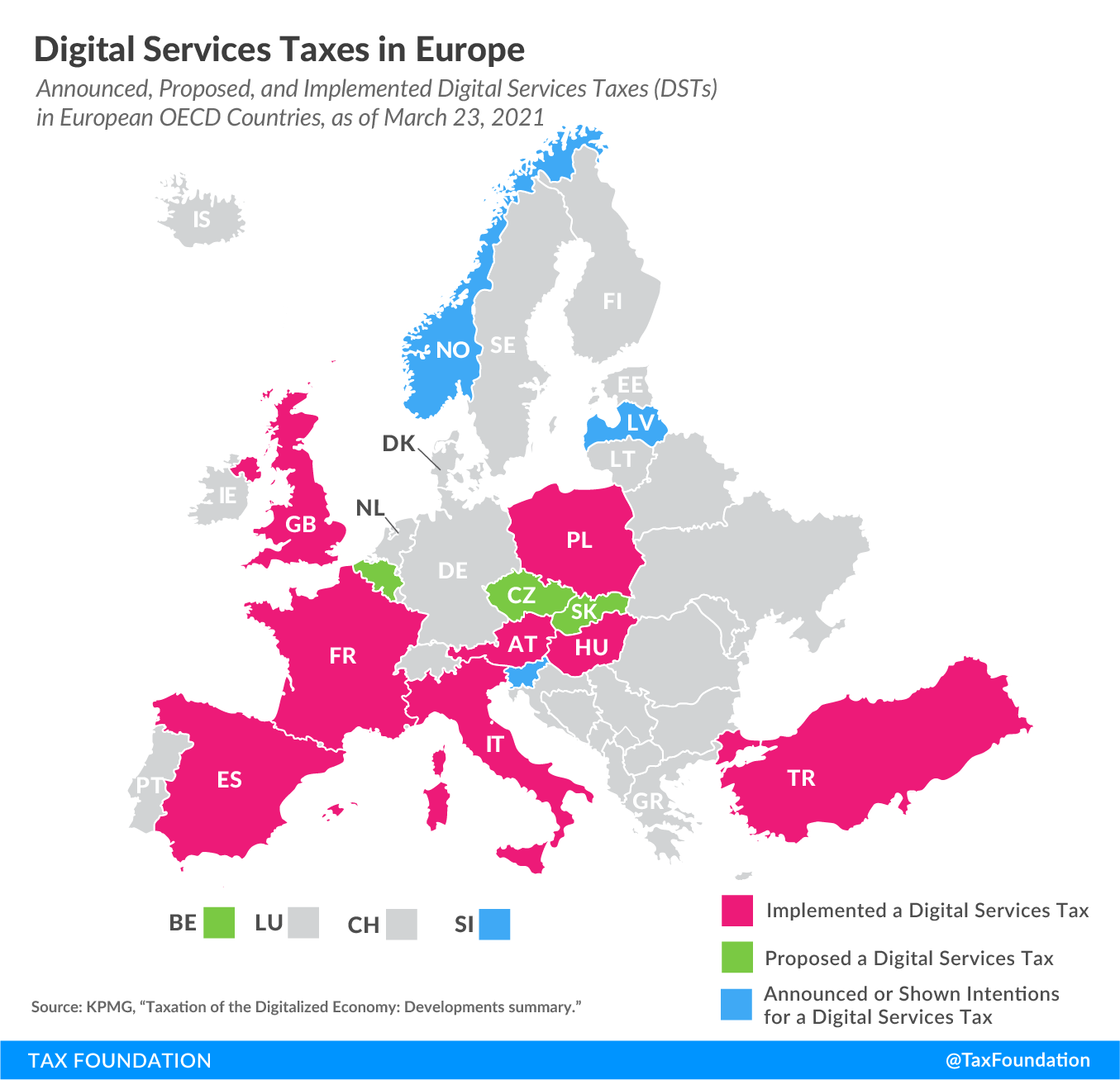

16 rows Proposed Discussions delayed due to COVID-19 pandemic. But the French government had suspended collections while negotiations on a. The 3 tax will be levied on sales generated in.

Section 301 Hearing in the Investigation of Frances Digital Services Tax Transcript- August 19 2019. The French Digital Service Tax DST will apply to the revenue generated from online intermediation services and the sale of targeted digital advertising in France. Section 301-Frances Digital Services Tax.

But several other governments have either proposed or enacted them in law including the UK which is scheduled to. This draft guidance focuses on compliance issues and also includes the first guidance on the scope and computation of the DST. The digital services tax is imposed at a rate of 3 on the gross revenues derived from digital activities of which French users are deemed to play a major role in value creation.

It will levy a 3 tax on revenue from digital services earned in France by companies that make more than 25 million euros 28 million in French revenue and 750 million euros 844 million in. France has resumed the collection of a digital services tax from major tech companies such after pausing the levy earlier this year according to a. France and other countries view digital service taxes as a way to raise revenue from the local operations of big tech companies which they say profit enormously from local markets while making only.

Initiation of a Section 301 Investigation of Frances Digital Services Tax- July 16 2019. There is a proposed. The digital services tax has provoked an angry response from Washington.

The 3 tax on revenue from digital services in the country was introduced last year. The following services are deemed to be made or supplied in France. The scope is limited to the largest internet companies worldwide taxable revenue exceeding 750M and French taxable revenue over 25M.

Location in France is determined by any means including the IP Internet Protocol address. It would apply to digital businesses with annual global revenue of more than. France is the European country with the furthest advanced digital service tax.

The law not only affects digital companies but more generally digital business models. The US had threatened to impose retaliatory tariffs on 24bn 18bn. The 3 digital services tax applies to revenues deemed to have been generated in France by digital companies wherever they are established which make annual supplies of taxable services of more than 25 million in France and 750m worldwide.

France Agrees To Delay New Tax On Tech Giants Bbc News

France Agrees To Delay New Tax On Tech Giants Bbc News

France Digital Services Tax Introduced Bdo

France Digital Services Tax Introduced Bdo

Who Is Surprised About France Advancing Its Digital Services Tax Det3

Who Is Surprised About France Advancing Its Digital Services Tax Det3

France Introduces Digital Services Tax Law Trust International

France Introduces Digital Services Tax Law Trust International

French Parliament Moves Ahead Passing Digital Services Tax Det3

French Parliament Moves Ahead Passing Digital Services Tax Det3

Breaking Down France S Digital Tax Atlantic Council

Battle Over Digital Tax In France Rages On Taxlinked Net

Battle Over Digital Tax In France Rages On Taxlinked Net

France Demands Digital Services Tax From Big Tech On Revenue Generated In 2020 Path Of Ex

France Demands Digital Services Tax From Big Tech On Revenue Generated In 2020 Path Of Ex

U S Suspends French Tariffs Over Digital Services Tax Cgtn

U S Suspends French Tariffs Over Digital Services Tax Cgtn

Digital Tax Update Digital Services Taxes In Europe

Digital Tax Update Digital Services Taxes In Europe

Us And France In Showdown Over Digital Tax

Us And France In Showdown Over Digital Tax

France S Digital Tax Riles The White House The Economist

France S Digital Tax Riles The White House The Economist

The Digital Tax Dispute A New Front In Trump S Trade War Cgtn

The Digital Tax Dispute A New Front In Trump S Trade War Cgtn

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.